Top chapter 13 bankruptcy Secrets

What transpires to your car, truck, van, motorbike, or A different car or truck in the event you file for Chapter thirteen bankruptcy? Learn the way filing for Chapter thirteen bankruptcy can help you keep the automobile from remaining repossessed and when you can use a cramdown to lessen the bank loan sum You'll have to pay.

to agree with no supplying consent being contacted by automated indicates, textual content and/or prerecorded messages. Fees could utilize.

The couple then started building payments to their trustee, who conveyed The cash to creditors and monitored Bill and Kathy’s development.

An important advantage of Chapter thirteen is always that a program is usually structured so that you can maintain your residence and car or truck. When you file for Chapter thirteen, creditors simply cannot foreclose on your home or repossess your car.

The Value to file Chapter thirteen bankruptcy is made of a $313 filing cost and costs billed by a bankruptcy attorney. As for paperwork together with other information, you need to provide:

A Chapter 13 bankruptcy normally stays on your own credit rating reviews for seven years through the day you submitted the petition. It could possibly lower your credit history rating by all-around 130 to 200 points, but the effects with your credit score diminish after a while. Whilst you repair service your credit, it may be tough to qualify for new loans or other types of credit score. There’s also stress to help keep up with the three- to five-yr program since missing payments may lead to a dismissal. In that case, you stand to lose any belongings you were being hoping to safeguard. Due to this, Chapter 13 bankruptcy needs to be employed read this post here as a last vacation resort. How to file for Chapter thirteen

Automobile financial loans guideBest automobile financial loans for good and lousy creditBest vehicle loans refinance loansBest lease buyout loans

These supplemental facts let our attorneys to gain a further comprehension of the specifics of the scenario

Secured debts contain collateral; illustrations consist of car financial loans and home financial loans. Filers ought to pay secured lenders no less than the value with the click here for more collateral if they would like to continue to keep it.

Unsecured debts are those that haven't any collateral, for example charge card credit card debt. They're paid out last and will not be paid in whole—or whatsoever. The bankruptcy court docket will look at the debtor’s disposable money in determining simply how much income unsecured creditors ought to get.

The time limits use only if you assume to discharge some personal debt, meaning you received’t need to repay it. You are able to file useful reference Chapter thirteen a lot more normally, however you can’t hope financial debt to get discharged Until you may have waited the expected time.

You received’t have to do something to obtain the Chapter 13 black mark removed from your credit report. The credit reporting company is supposed to do that immediately.

Consolidating might also conserve you funds on desire in the event you’ve enhanced top article your credit rating score due to the fact using out your unique financial loans. Also, debt consolidation loans commonly feature reduce rates than credit cards.

If you didn’t accomplish that when you submitted your petition, you’ll have fourteen times to provide the court your repayment plan. The courtroom will also problem you click to investigate a trustee.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Destiny’s Child Then & Now!

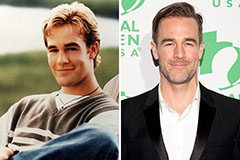

Destiny’s Child Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Barbara Eden Then & Now!

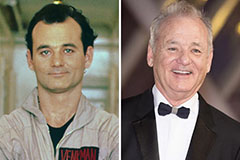

Barbara Eden Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!